MIFIDPRU 8 Disclosure

May 2025

.png)

Introduction

The Financial Conduct Authority (“FCA” or “regulator”) in the Prudential sourcebook for MiFID Investment Firms in the FCA Handbook(“MIFIDPRU”) sets out the detailed prudential requirements that apply to Proterra Investment Partners LLP (or the “Firm”). Chapter 8 of MIFIDPRU(“MIFIDPRU 8”) sets out public disclosure rules and guidance with which the Firm must comply, further to those prudential requirements.

Firm is classified under MIFIDPRU as a small and non-interconnected MIFIDPRU investment firm (“SNI MIFIDPRU Investment Firm”). As such, the Firm is required by MIFIDPRU 8 to disclose information regarding its remuneration policy and practices.

The purpose of these disclosures is to give stakeholders and market participants an insight into the Firm’s culture and to assist stakeholders in making more informed decisions about their relationship with the Firm.

This document has been prepared by Firm in accordance with the requirements of MIFIDPRU 8 and is verified by the Members. Unless otherwise stated, all figures are as at the Firm’s 31 December financial year-end.

Remuneration Policy and Practices

Overview

As an SNI MIFIDPRU Investment Firm, Firm is subject to the basic requirements of the MIFIDPRU Remuneration Code (as laid down in Chapter19G of the Senior management arrangements, Systems and Controls sourcebook in the FCA Handbook (“SYSC”)). The purpose of the remuneration requirements is to:

- Promote effective risk management in the long-term interests of the Firm and its clients;

- Ensure alignment between risk and individual reward;

- Support positive behaviours and healthy firm cultures; and

- Discourage behaviours that can lead to misconduct and poor customer outcomes.

The objective of Firm’s remuneration policies and practicesis to establish, implement and maintain a culture that is consistent with, andpromotes, sound and effective risk management and does not encouragerisk-taking which is inconsistent with the risk profile of the Firm and theservices that it provides to its clients.

In addition, Firm recognises that remuneration is a key component in how the Firm attracts, motivates, and retains quality staff and sustains consistently high levels of performance, productivity, and results. As such, the Firm’s remuneration philosophy is also grounded in the belief that its people are the most important asset and provide its greatest competitive advantage.

Firm is committed to excellence, teamwork, ethical behaviour, and the pursuit of exceptional outcomes for its clients. From a remuneration perspective, this means that performance is determined through the assessment of various factors that relate to these values, and by making considered and informed decisions that reward effort, attitude, and results.

Characteristics of the Firm’s Remuneration Policy and Practices

The compensation structure for a member of the investment team generally consists of: base salary, annual bonus, and other benefits such as health & life insurance and contributions to individual pension or retirement plans. Additionally, certain members of the investment team are awarded carried interest. Proterra’s compensation philosophy is to ensure that the compensation structure creates alignment and helps to attract, motivate, reward and retain employees who create value.

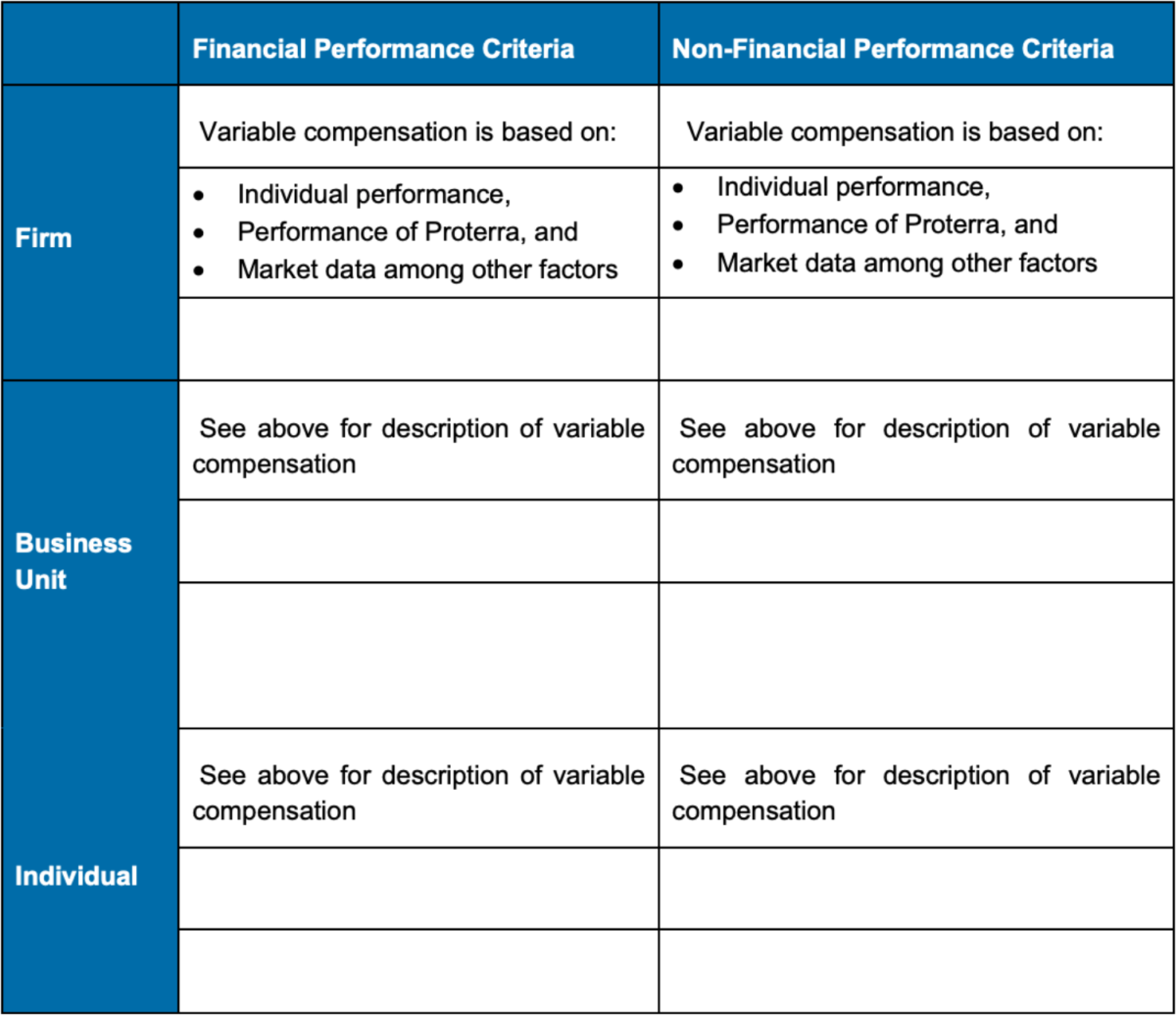

The below table summarises the financial and non-financial criteria of performance used across the Firm in assessing the level of variable remuneration to be paid:

The fixed and variable components of remuneration are appropriately balanced: the fixed component represents a sufficiently high proportion of the total remuneration to enable the operation of a fully flexible policy on variable remuneration. This allows for the possibility of paying no variable remuneration component, which the Firm would do in certain situations, such as where the Firm’s profitability performance is constrained, or where there is a risk that the Firm may not be able to meet its capital or liquidity regulatory requirements.

Governance and Oversight

The Firm’s Members are responsible for setting and overseeing the implementation of Firm’s remuneration policy and practices. In order to fulfil its responsibilities, the Firm’s Members:

- Are appropriately staffed to enable it to exercise competent and independent judgment on remuneration policies and practices and the incentives created for managing risk, capital, and liquidity.

- Prepares decisions regarding remuneration, including decisions that have implications for the risk and risk management of the Firm.

- Ensures that the Firm’s remuneration policy and practices take into account the public interest and the long-term interests of shareholders, investors, and other stakeholders in the Firm.

- Ensures that the overall remuneration policy is consistent with the business strategy, objectives, values, and interests of the Firm and of its clients.

Firm’s remuneration policy and practices are reviewed annually by the Firm’s Members.

Quantitative Remuneration Disclosure

For the financial year 1 January to 31 December 2024, the total amount of remuneration awarded to all staff was £135 thousand, of which £135 thousand comprised the fixed component of remuneration, and £0 thousand comprised the variable component. For these purposes, ‘staff’ is defined broadly, and includes, for example, employees of the Firm itself, and secondees.